Every executive team is focused on the financials. They care about revenue and their organization’s financial results. Understanding how to relate the value of what we do in product storytelling to business results and money is a key factor in getting teams funded and being trusted with our roadmap priorities. Ideally, product initiatives make sense strategically AND financially in delivering value to the business.

If we want to get promoted into a senior leadership role in product, we can’t successfully execute this role without a good grasp on what business viability and value to the business are.

There are obviously more dimensions to business viability than just the numbers of the current month: For example, the strategic value of opening a new market or customer segment and compliance topics. This article focuses on how to think about financial numbers in the context of product decisions.

Basic financial statements:

Get started by learning what financial statements are and how our decisions in product impact them. Come up with a basic Business Case Model to use for the evaluation of different initiative ideas. And go find out what Financial metric matters the most in the context of your organization.

Executive teams typically look at a Balance Sheet, the Profit and Loss Statement (also called Income Statement), and Cash Flow Statements, plus a number of key financial metrics for their regular financial reviews. They also pay close attention to how their financial forecasts (budget) compare to the actual numbers of each month.

In a Balance Sheet, you can see:

A healthy balance sheet has more Assets than Liabilities. When you see liabilities increase while assets do not, you can tell that the company is not in a great place financially. This can, for example, happen when a company owes a lot of money to financial institutions and the interest rates rise.

Which is one of the reasons a number of companies have been struggling with their finances most recently. If your company’s products then don’t make enough revenue to cover those interest payments, your CFO might be forced to take a look at expenses they can control: e.g. the money spent on payroll, which can lead to layoffs or hiring freezes.

In a Profit and Loss Statement, you can see:

A healthy P&L statement will show more Income than Expenses and a nice Net Profit as a result of everything you’re doing. What is important here is how to shift the numbers:

Your CFO usually breaks these numbers down further.

They will break down the money flow in a Cash Flow statement to see exactly at what point in the month payments come in and go out and that they always have enough Cash in Hand to make payroll payments or payments to suppliers and banks.

They also break the numbers down by what is truly core to the business (revenue generated and directly applicable cost for that), vs. other expenses like interest payments, taxes, or depreciation on assets. As a result, they arrive at a metric called EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). That is a number a lot of CFOs watch closely for the following reason:

Anything that leads to more direct revenue and everything that leads to extra cost has a multiplier effect on your ability to get funding or sell your company at a great price. It might also mean access to a loan from the bank. And if expenses exceed income for too long your organization risks bankruptcy. Which has legal implications for your entire organization.

This explains why sales and marketing (which are typically associated with bringing in revenue growth) are so popular and often have so much power in organizations.

Telling good financial stories with Business Cases:

When we fail to tell good stories about revenue growth or cost savings as a result of our product efforts, we are seen as a team that merely produces cost (in the form of payroll and other expenses), not as a revenue generating function that helps us grow the company.

But it is easy for us in product to change the stories we tell our executive team about our roadmap decisions. We do this by first understanding our business model, then making some basic calculations about the initiatives we want to prioritize and then translating these into stories about money.

Getting a basic business case model in place will help you understand how you can positively impact Revenue (or reduce cost) and also how to think of multiple different initiatives and their financial value to your organization.

I would typically recommend making a quick estimate calculation of revenue impact and cost impact for a period of about three years. Why three years?

Because for most work we do, we first have a heavy cost to pay (the payroll for the number of sprints it takes to get something done) before we can see the effects on revenue increase (or cost savings) later.

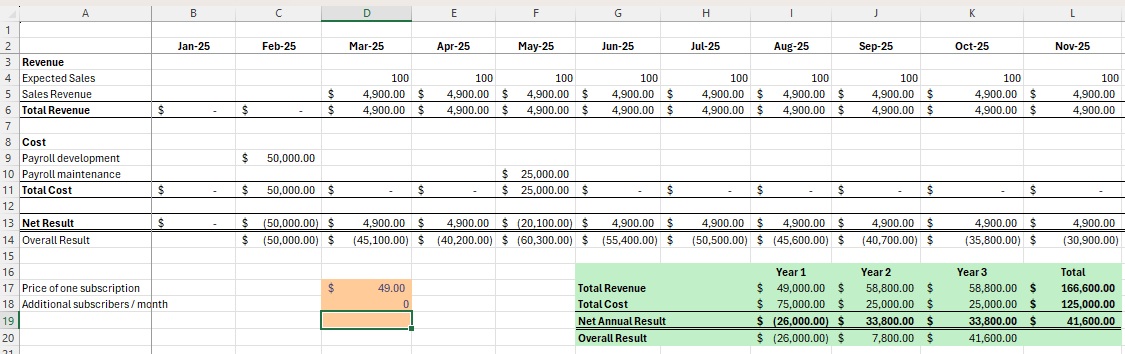

Here is an Example for a Subscription Business Case:

A new feature aims to gain 100 new customers per month that will buy your standard subscription at USD 49. The average Customer Lifetime of a new subscriber is 36 months. (100 customers x USD 49 x 36 months = USD 176000 for every 100 customers gained in a month).

Let’s assume you need a month to build this new feature set, which means two Sprints at USD 25k each. Within three months, you plan to do one sprint for updates and bug fixes and an additional Sprint of maintenance work in each of the subsequent years.

As you model this out, you’ll see that initially, you’re creating more cost, and only over time will you make relatively more revenue out of this new feature set.

A very basic model based on this example might look like this:

Realistically you’d probably need additional information in there. This currently has no assumption of churn or related server costs.

Sticking with this very basic model, you could also calculate assumptions of growth in sales, which would change these numbers quite a bit over time. With just 10 extra subscribers each subsequent month, the profit increases from USD 41k over three years to USD 316k in this model:

How might you now use this for prioritization decisions and good financial storytelling?

Imagine you’d have to justify your idea for the creation of 10 extra subscribers per month vs. the proposal of Mike in sales, who says their deal makes USD 30k in extra revenue one time in the coming month.

While the short-term impact of your work in the three months does not look that great, over time, this will create a much bigger piece of revenue.

What matters now is to be aware of what financial metric your company currently most cares about:

Remember when I initially said that you should talk to your finance team to find out what numbers matter? Here is what I suggest you do:

Go to your Finance team and asking them questions about their goals. You can ask whether growth or profitability are currently the goal. What size Business Case would materially impact the company success. And what Financial metrics the Executive Team and Board regularly review.

You will almost certainly build trust and credibility by seeking this information. It shows them that you care about the business impact of your prioritization decisions. And it is a great way to say “no” to requests for features or work pieces that have no business or strategic impact.

Now coming back to the need to prioritize between your feature idea and Mike’s proposal:

The financial story to tell could sound like this:

This business case will result in USD 41K over three years without projected user growth, but could deliver as much as USD 316 if we manage to sell 10 additional subscriptions on a monthly basis. We know that 250 people per month actively ask for this through our red door test, so this seems like a conservative estimate. Mike’s proposal would deliver a one time profit of EUR 30k. We suggest to go with our subscription feature idea.

Remember: using numbers for prioritization decisions or, for example, asking for funding for extra people always plays within the larger context of your company’s financial situation. It’s important to understand if your company currently optimizes for growth or profitability. Or whether you are preparing to get funding or want to sell your organization.

Understanding that context allows you to frame the work you do in financial stories that matter in your context. That is why it is so important to understand and have good rapport with your Finance team: They can tell you what financial metrics currently matter in your organization.

Ultimately, you’re all sitting in the same boat: your organization has to be profitable enough to pay all its expenses and reach its next funding or exit goal. We do this by also staying focused on customer needs and the impact we look to achieve with our vision and strategy. And by building strong inclusive team cultures.

If you’d like to learn more because the numbers confuse you, and if you want to get access to a simple business case template, or want somebody to take a look at your initial business case model, feel free to reach out anytime! You can also sign up for my three week Business and Finance Concepts for Product and Tech Leaders Course where we’ll work on creating a Business Case template tailored to your context.

The price is very affordable with EUR 399 for 3x 60 min small group learning sessions and 1x 60min personalized coaching session 1:1 just for you.

Cover Photo by Towfiqu barbhuiya on Unsplash. This article was first published in slightly different form through the Mind the Product Blog on February 4th 2025.

___________________________

I coach, speak, do workshops and blog about #leadership, #product leadership, #AIEthics #innovation, the #importance of creating a culture of belonging and how to succeed with your #hybrid or #remote teams.

Get my latest blog posts delivered directly to your inbox.

Your email address will only be used for receiving emails with my latest blog posts in them. You can unsubscribe at any point in time.

If you enjoyed reading this post, you may enjoy the following posts as well:

The RoI of AI initiatives and the realistic cost of AI readiness

We live in this funny world, where for a few quarters we currently get to play with AI use cases without having to show the RoI of our efforts just yet. But AI will not change the rules of business at a fundamental level. Profitability, EBITDA, revenue growth and cost efficiency will continue to matter…

Your first 90 days in your new product leadership role

Congrats! You have just been promoted, or you were hired into a new product leadership role. That’s super exciting, and also the best time to make an intentional plan for how to succeed in it. The first three months count in setting you up for success (or learning fast, that this particular role is not…

The core Jobs To Be Done for a product leader

Whenever I coach a newly promoted product leader one of the first questions they ask is what the job of a product leader even is. They often feel very insecure about their new responsibilities and lost as to where to get started and whose input to trust. Product Leaders are often advised to develop a…

How Product Leadership must evolve in the age of AI

When the internet became mainstream it had a huge effect on how organizations and teams worked and collaborated. The whole digital software product space came into existence at the time. AI is an equally big new influence affecting teams today, and the role of Product Leadership has to evolve again. There are two main perspectives…

So you want a high performing product team?

Many years ago, I started pondering this question. What makes a high performing product team? What can I learn about this and how do I apply my findings in practice? The theory is pretty simple: Build something both customers and your organization value, do it with a great team. But the practice of this is…

How to think and talk about business impact

About 8 years ago I had just started in a new product role. I wanted to get to know my key stakeholders and understand this organization’s business. I was lucky that the CFO and me both worked in the same office, physically close to each other. I wanted to understand what kind of business case…